Ncua Insured Funds Brochure

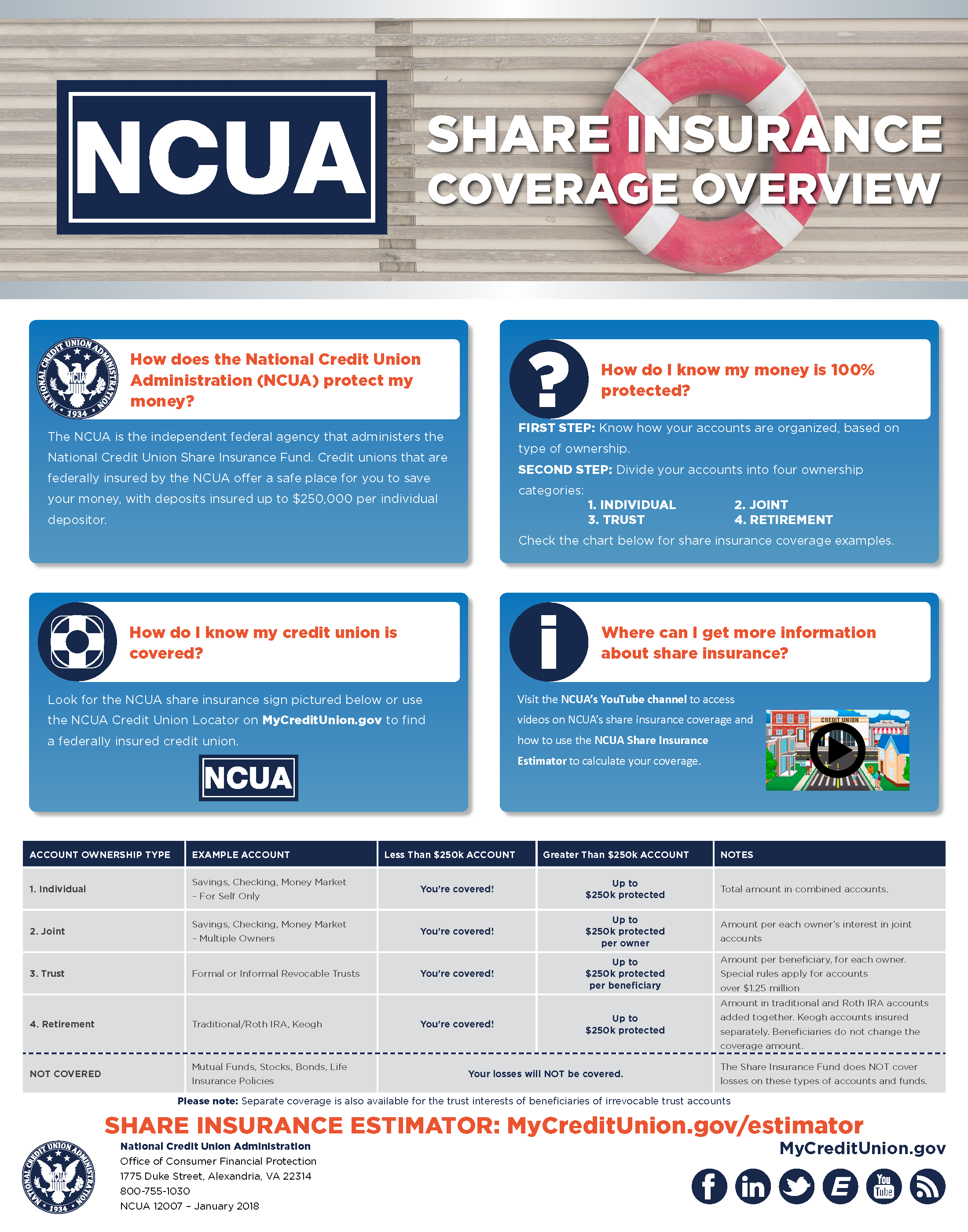

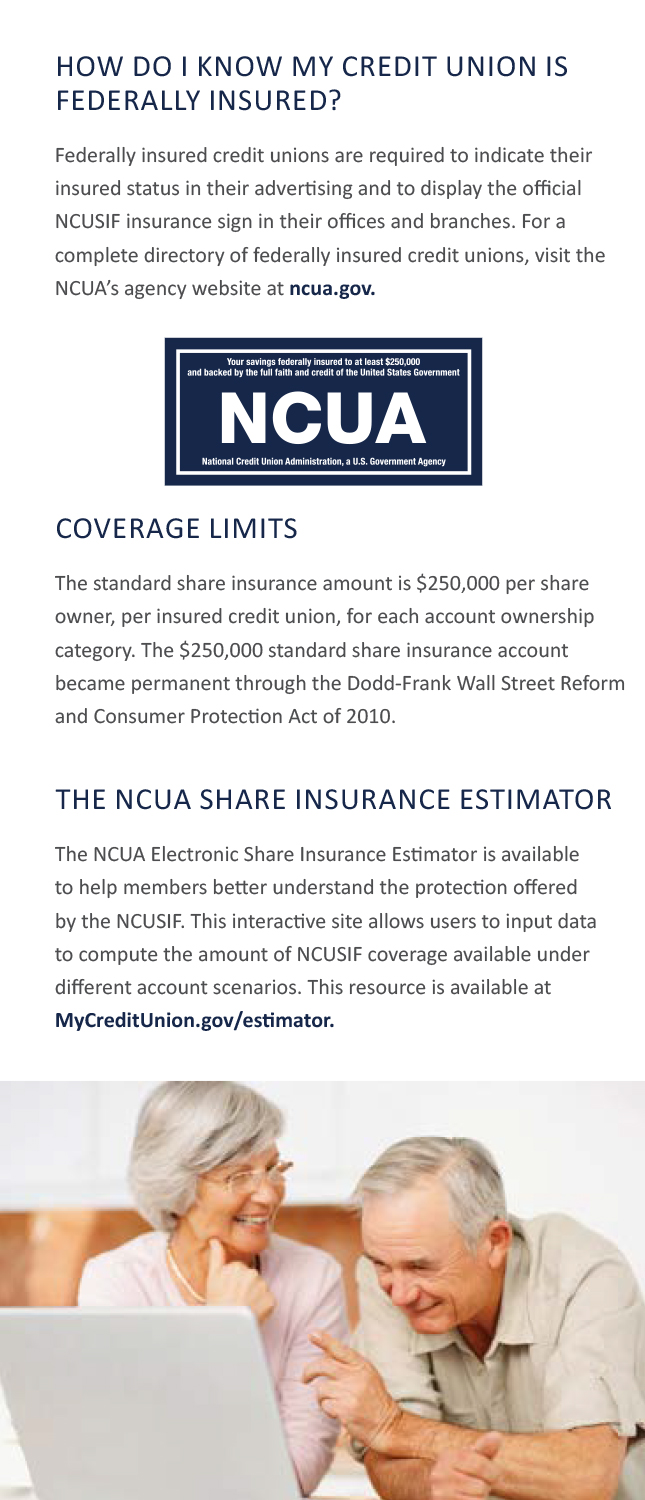

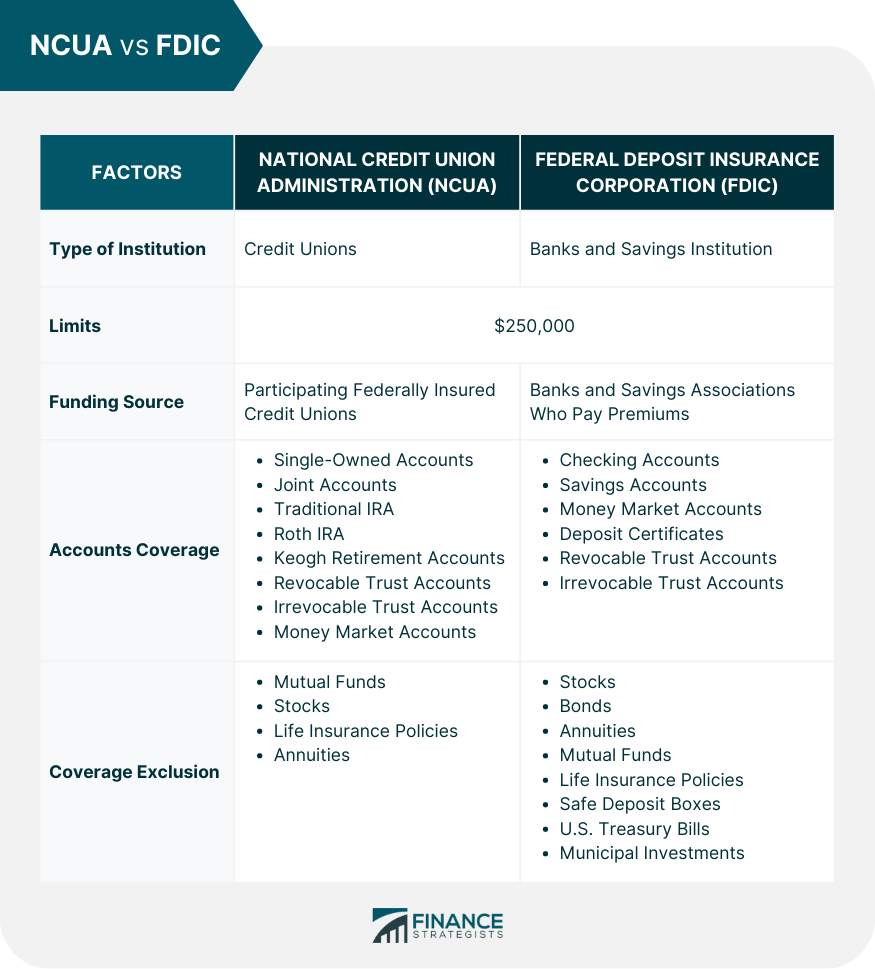

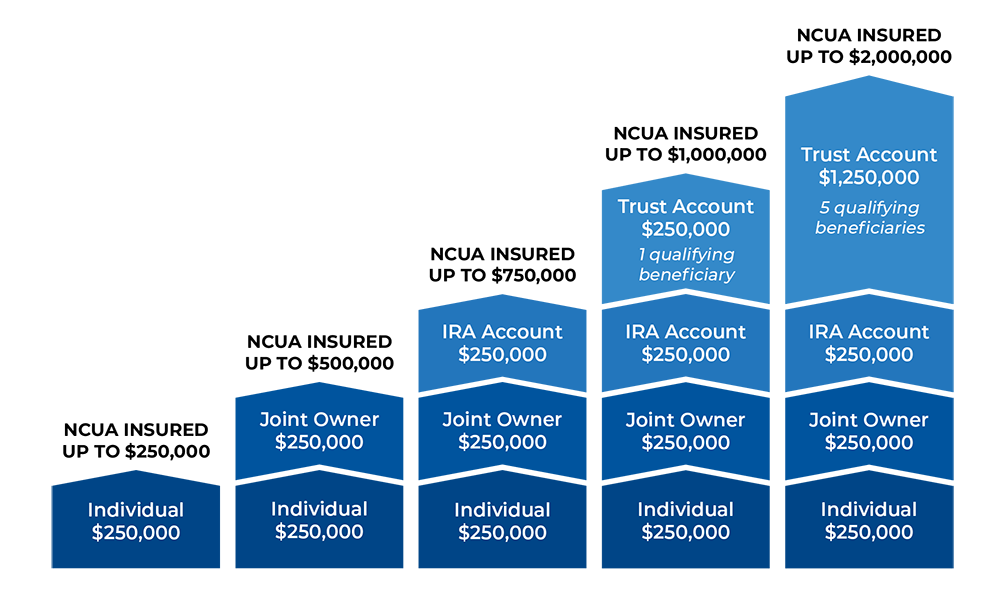

Ncua Insured Funds Brochure - Educate your members about ncua's share insurance coverage with these professionally designed brochures. How does the national credit union administration (ncua) protect my money? Explore the details of ncua’s share insurance coverage with this informative brochure. Because the scope of this brochure is limited, credit union. How can i get more information?. This video offers a synopsis of the different. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. Because the scope of this brochure is limited, credit union. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Because the scope of this brochure is limited, credit union. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Because the scope of this brochure is limited, credit union. The ncua is the independent federal agency that administers the national credit union share insurance fund. The updated booklet, 61 pages long, explains how credit union members' accounts are covered by the national credit union share insurance fund. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. This video offers a synopsis of the different. The standard share insurance amount is $250,000 per share. The national credit union administration, commonly referred to as ncua, is the federal government agency that charters and supervises federal credit unions. Because the scope of this brochure is limited, credit union. The updated booklet, 61 pages long, explains how credit union members' accounts are covered by the national credit union share insurance fund. Fund comparison toolinvestment toolsactively managed fundslow cost funds Because the scope of this brochure is limited, credit union. The standard share insurance amount is $250,000 per share. A comprehensive booklet entitled your. The ncua is the independent federal agency that administers the national credit union share insurance fund. This video offers a synopsis of the different. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Because the scope of this brochure is limited, credit union. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. This video provides an overview on ncua share insurance, which protects deposits. Because the scope of this brochure is limited, credit union. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. Ncua regulates, charters, and insures the nation’s federal credit unions. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. Because the scope of this brochure is limited, credit union. The ncua is the independent federal agency that administers the national credit union share insurance fund. The standard share insurance amount is $250,000. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. The ncua is the independent federal agency that administers the national credit union share. The standard share insurance amount is $250,000 per share. The ncua is the independent federal agency that administers the national credit union share insurance fund. A comprehensive booklet entitled your. Explore the details of ncua’s share insurance coverage with this informative brochure. Federally insured credit unions are required to indicate their insured status in their advertising and to display the. How can i get more information?. Ncua regulates, charters, and insures the nation’s federal credit unions. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. For a complete directory of federally insured credit unions, visit the ncua’s agency website at ncua.gov. A comprehensive booklet entitled your. This video provides an overview on ncua share insurance, which protects deposits held at federally insured credit unions. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. The ncua is the independent federal agency that administers the national credit union share insurance. A comprehensive booklet entitled your. Ncua regulates, charters, and insures the nation’s federal credit unions. Because the scope of this brochure is limited, credit union. The standard share insurance amount is $250,000 per share. Explore the details of ncua’s share insurance coverage with this informative brochure. Because the scope of this brochure is limited, credit union. The updated booklet, 61 pages long, explains how credit union members' accounts are covered by the national credit union share insurance fund. The national credit union administration, commonly referred to as ncua, is the federal government agency that charters and supervises federal credit unions. The standard share insurance amount is $250,000 per share. This video provides an overview on ncua share insurance, which protects deposits held at federally insured credit unions. This video offers a synopsis of the different. A comprehensive booklet entitled your. Because the scope of this brochure is limited, credit union. Explore the details of ncua’s share insurance coverage with this informative brochure. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. The ncua is the independent federal agency that administers the national credit union share insurance fund. A comprehensive booklet entitled your. Ncua has more information available to help credit union members better understand how the ncusif keeps their accounts safe and protected. How does the national credit union administration (ncua) protect my money? How can i get more information?. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts.Insured Funds Brochure PDF National Credit Union Administration

Best Practices to Keep Your Money Insured

NCUA Booklet Your Insured Funds Pack of 50

How Your Accounts Are Federally Insured Hawaiian Financial Federal

National Credit Union Administration

NCUA Brochure for Credit Unions Your Insured Funds

Certificate Accounts BankFund Credit Union

Your Money is Federally Insured Through the NCUA

NCUA Signage

Ncua Magazines

Federally Insured Credit Unions Are Required To Indicate Their Insured Status In Their Advertising And To Display The Oficial Ncusif Insurance Sign In Their Ofices And Branches.

Educate Your Members About Ncua's Share Insurance Coverage With These Professionally Designed Brochures.

Ncua Has More Information Available To Help Credit Union Members Better Understand How The Ncusif Keeps Their Accounts Safe And Protected.

Ncua Regulates, Charters, And Insures The Nation’s Federal Credit Unions.

Related Post: