Fdic Brochure Your Insured Deposits

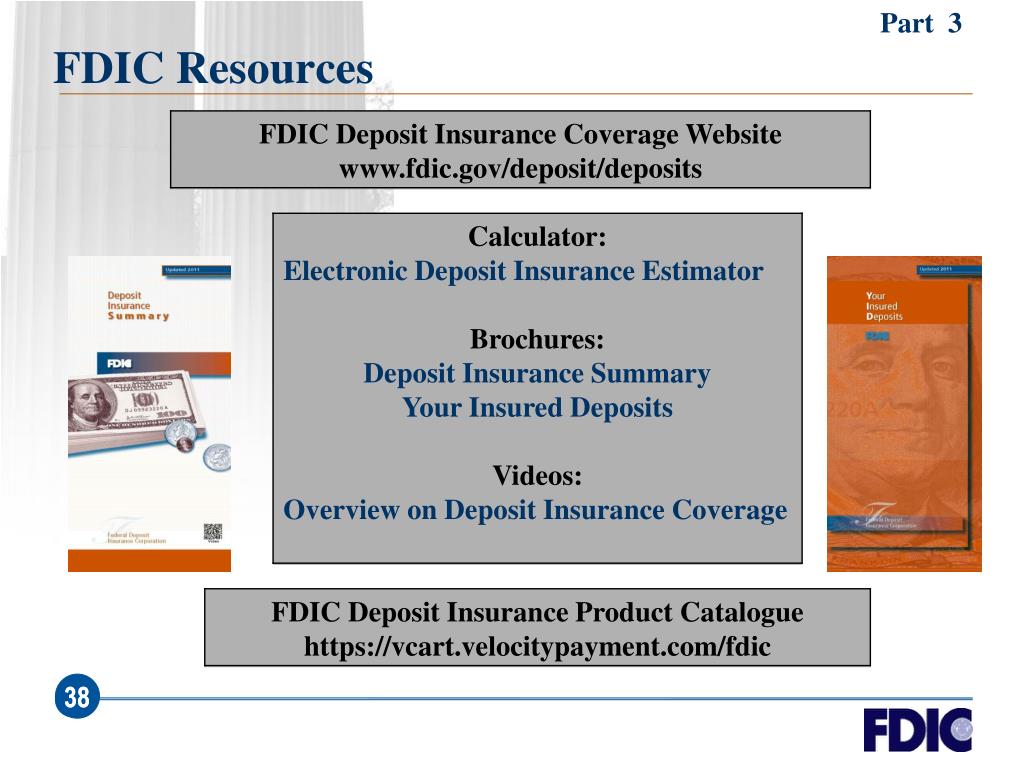

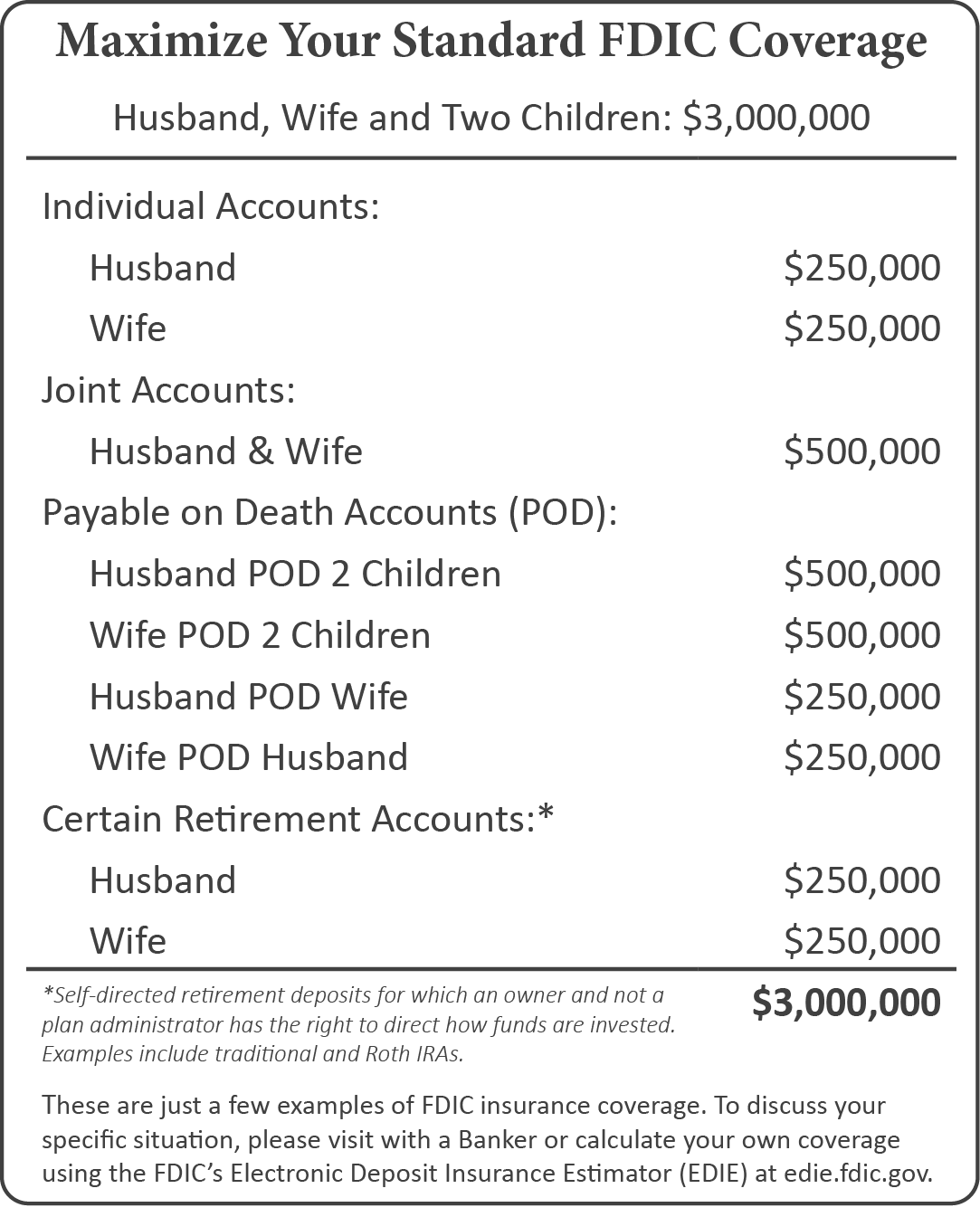

Fdic Brochure Your Insured Deposits - This brochure is not intended as a legal interpretation of the fdic’s. About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. Your insured deposits is a. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. Citizen or resident to have his or her deposits insured by the fdic. In the u.s., all federally chartered banks are required to have fdic insurance, and. For additional or more specific information about fdic insurance coverage,. Whose deposits does the fdic insure? Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. Since the fdic was founded in 1933, no depositor has. Any person or entity can have fdic insurance coverage in an insured bank. Your insured deposits is a. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. This brochure is not intended as a legal interpretation of the fdic’s. In the u.s., all federally chartered banks are required to have fdic insurance, and. Whose deposits does the fdic insure? Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Citizen or resident to have his or her deposits insured by the fdic. Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. Whose deposits does the fdic insure? Since the fdic was founded in 1933, no depositor has. Fdic insurance covers all types of deposits received at an insured bank, including deposits in. This brochure is not intended as a legal interpretation of the fdic’s. This brochure is not intended as a legal interpretation of the fdic’s. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. This brochure your insured deposits describes federal deposit insurance. A person does not have to be a u.s. Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. This brochure is not intended as a legal interpretation of the fdic’s. In the u.s., all federally chartered banks are required to. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. Browse our collection of financial education materials, data tools, documentation. Fdic insurance covers all types of deposits received. In the u.s., all federally chartered banks are required to have fdic insurance, and. About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. Any person or entity can have fdic insurance coverage in an insured bank. Whose deposits does the fdic insure? The fdic charges banks a. For additional or more specific information about fdic insurance coverage,. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. Whose deposits does the fdic insure? About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. This brochure is not intended as a legal. Your insured deposits is a. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. Browse our collection of financial education materials, data tools, documentation. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Fdic insurance covers all. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. For additional or more specific information about fdic insurance coverage,. This brochure is not intended as a legal interpretation of the fdic’s. Since the fdic was founded in 1933, no depositor has. Fdic insurance covers all types of deposits. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Whose deposits does the fdic insure? This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Any person or entity can have. Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. Browse our collection of financial education materials, data tools, documentation. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. Your insured deposits is a. This. Whose deposits does the fdic insure? Citizen or resident to have his or her deposits insured by the fdic. This brochure is not intended as a legal interpretation of the fdic’s. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. In the u.s., all federally chartered banks are required to have fdic insurance, and. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s. A person does not have to be a u.s. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Your insured deposits is a. For additional or more specific information about fdic insurance coverage,. Since the fdic was founded in 1933, no depositor has. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. Browse our collection of financial education materials, data tools, documentation. Any person or entity can have fdic insurance coverage in an insured bank.FDIC’s Guide to Deposit Insurance Coverage Federal Deposit Insurance

PPT FDIC Seminar On Revocable Trust Accounts For Bankers PowerPoint

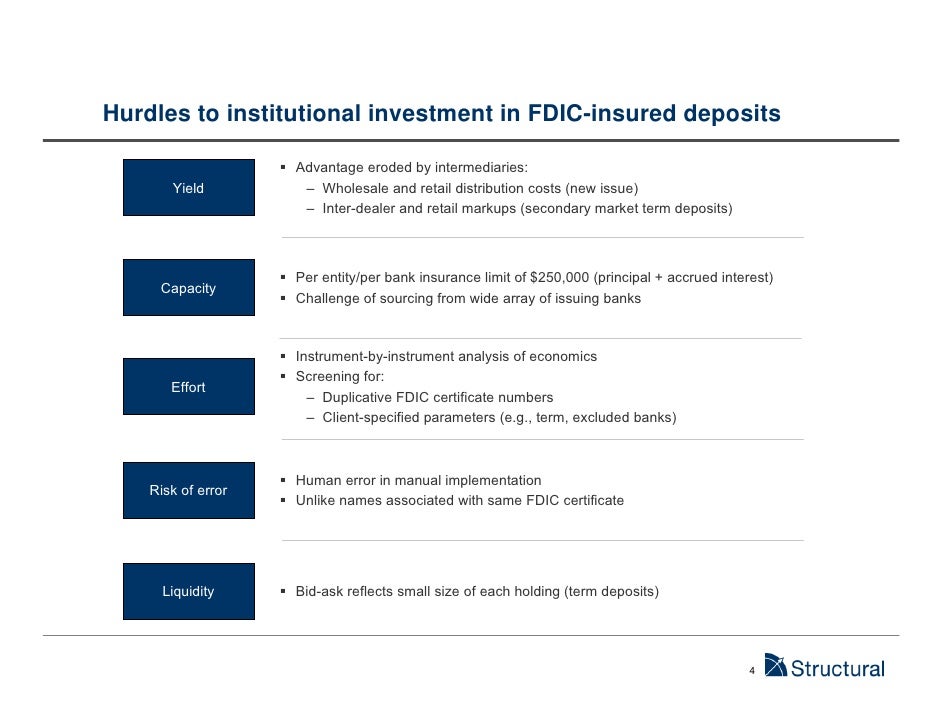

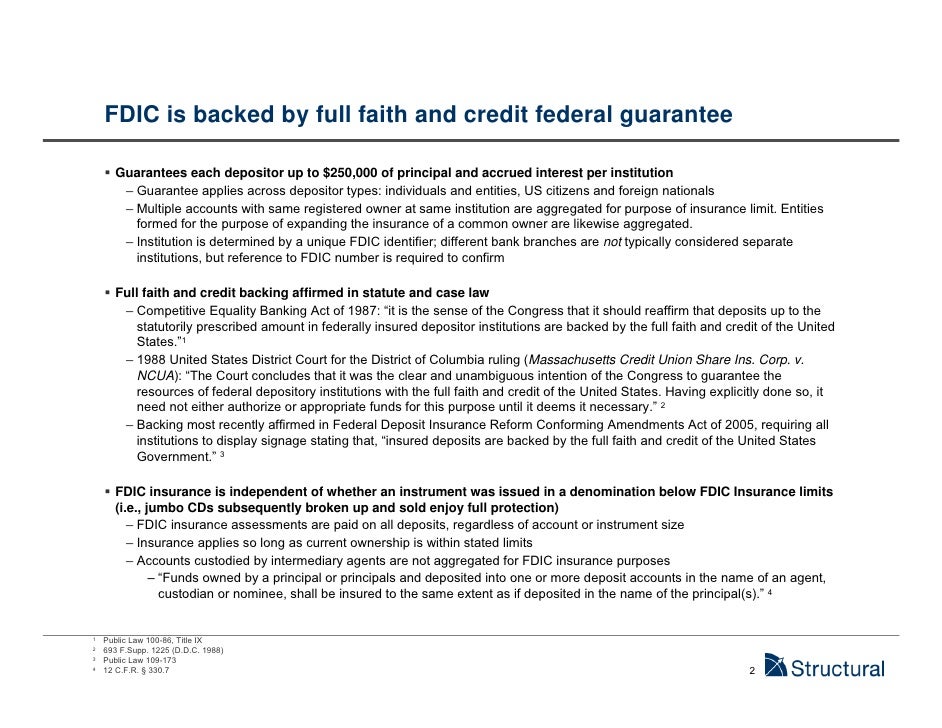

Structural FDIC Insured Deposits

Fdic Your Insured Deposits English PDF Federal Deposit Insurance

FDIC Deposit Insurance Brochure 4 Panel Folded

Safe Sound and FDICInsured United Community Bank

FDIC Deposit Insurance at a Glance Brochure by Traditions Bank Issuu

FDIC Deposit Insurance Brochure 4 Panel Folded

FDIC Booklet

Structural FDIC Insured Deposits

Any Person Or Entity Can Have.

About This Brochure Your Insured Deposits Is A Comprehensive Description Of Fdic Deposit Insurance Coverage For The Most Common Account Ownership Categories.

For Additional Or More Specific Information About Fdic Insurance Coverage,.

This Brochure Your Insured Deposits Describes Federal Deposit Insurance Corporation (Fdic) Deposit Insurance Coverage For The Most Common Accounts Ofered To.

Related Post: